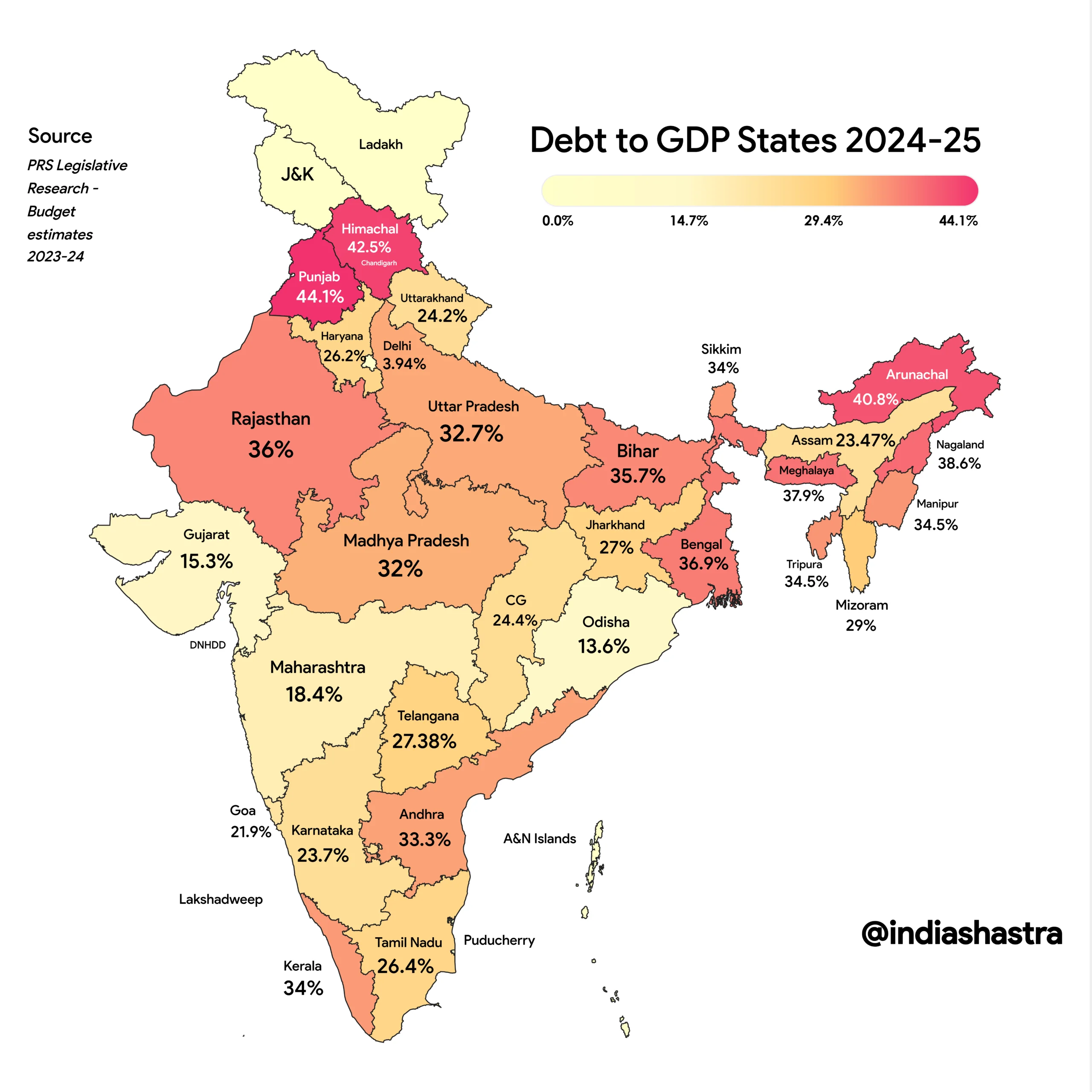

In this post, we will take a look at the Debt to GDP Ratio of Indian States in 2024-25. You will understand what is debt-gdp ratio and why it is important. And state wise debt-gdp ratio of Indian states.

Debt-to-GDP ratio is an economic metric that compares a country’s (or a state’s) total debt to its Gross Domestic Product (GDP). It measures how much debt a government has relative to the size of its economy and indicates the government’s ability to repay its debt.

Formula:

Know the Terms Debt and GDP

- Debt: The total amount of money the government owes to creditors.

- GDP: The total value of goods and services produced in the economy over a specific time period.

Debt-to-GDP and Fiscal Deficit Data (FY 2024-25 Budget Estimate)

| State | Debt-to-GDP (%) | Fiscal Deficit (%) |

|---|---|---|

| Andhra Pradesh* | 33.30 | 3.8 |

| Arunachal Pradesh | 40.80 | 6.3 |

| Assam | 23.47 | 3.5 |

| Bihar | 35.70 | 3.0 |

| Chattisgarh | 24.40 | 3.7 |

| Delhi | 3.94 | 0.7 |

| Goa | 21.90 | 2.5 |

| Gujarat | 15.30 | 1.9 |

| Haryana | 26.20 | 2.8 |

| Himachal Pradesh | 42.50 | 4.7 |

| Jharkhand | 27.00 | 2.0 |

| Karnataka | 23.70 | 3.0 |

| Kerala | 34.00 | 3.4 |

| Madhya Pradesh | 32.00 | 4.1 |

| Maharashtra | 18.40 | 2.6 |

| Manipur | 34.50 | 3.1 |

| Meghalaya | 37.90 | 3.8 |

| Mizoram | 29.00 | 2.8 |

| Nagaland | 38.60 | 3.0 |

| Odisha | 13.60 | 3.5 |

| Punjab | 44.10 | 3.8 |

| Rajasthan | 36.00 | 3.9 |

| Sikkim | 34.00 | 5.4 |

| Tamil Nadu | 26.40 | 3.4 |

| Telangana | 27.38 | 3.0 |

| Tripura | 34.50 | 4.0 |

| Uttar Pradesh | 32.70 | 3.46 |

| Uttarakhand | 24.20 | 2.4 |

| West Bengal | 36.90 | 3.6 |

What Does it Mean

- High Ratio is bad: The government might struggle to repay its debts without incurring additional debt or raising taxes. It could also signal potential fiscal instability.

- Low Ratio: This suggests that the government is better positioned to manage its debt because its economy is large enough to support repayments.

Why Debt-GDP Ratio Matters

- It’s a key indicator of fiscal health.

- It helps investors, analysts, and policymakers assess the financial stability and creditworthiness of a government.

- Governments with a high debt-to-GDP ratio may face difficulties borrowing money at favourable rates because of perceived higher risk.

Example

- If a state’s debt-to-GDP ratio is 44%, its total debt is 44% of the value of all goods and services it produces in a year.

view image in HQ